5 Reasons Why Its Important To Teach Your Child About Money

The mountain is steeper for our children

There’s no doubt about it. It's harder for our generation to get ahead financially than it was for our parents, and it will be even tougher for our children. Here are 5 reasons why your child must learn about earning, saving, borrowing, lending, and investing to succeed in today's economy.

1. Instant gratification

We live in an age of instant gratification where almost anything is accessible with a few clicks. Our children are more familiar with paying with plastic than using cash, which makes it harder to track spending. Young adults have easy access to credit, and borrowing to live beyond their means is largely accepted. This can lead to bad spending habits, resulting in student, personal, and household debt.

2. Poverty

According to a new Bankrate survey conducted in December 2023, when faced with an unexpected $1,000 expense, more than one-third of Americans would need to borrow the money. This could involve using credit cards, borrowing from friends or family, or taking out a personal loan. Most would not use cash savings because they don't have sufficient funds, the survey found. Additionally, research has found living paycheck to paycheck has become the norm for many Americans, which leaves them little opportunity to save.

Less affluent children are less likely to have experience with, or positive role models for, saving and investing. They often spend what they earn without realizing there's a way to improve their financial future.

3. Debt

Today's youth are more at risk of incurring bad debt than any previous generation. With greater access to cell phone plans, online shopping, credit cards, and high-interest loans, they often lack the knowledge to make sound financial decisions. They are targeted by payday loan sharks and influenced by pervasive consumer advertising. As debt mounts, the financial education needed to avoid and manage debt is largely lacking.

4. Housing prices

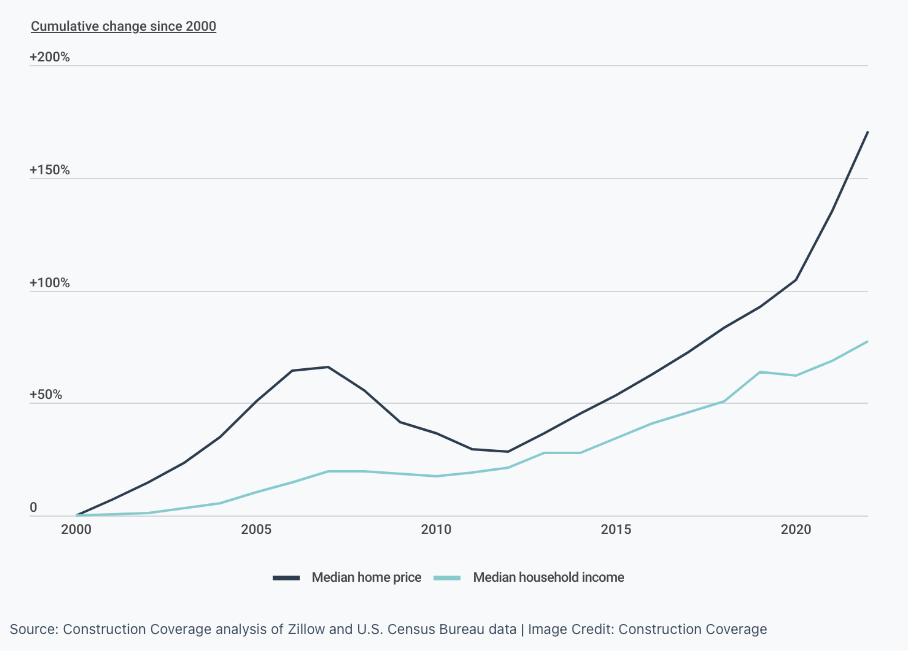

Household income is not keeping pace with property prices.

According to data from the U.S. Census Bureau and Zillow, from 2000 to 2022, the median annual household income in the U.S. rose by 78%, from $41,990 to $74,580. In contrast, the median home price nearly tripled, increasing by 170%, from $123,086 to $332,826. (Source: Construction Coverage).

It's no surprise that the number of first-time homebuyers is declining. Our kids will need a solid plan to make wise financial decisions early on to get on the property ladder.

5. Financial opportunities

Our children have more financial opportunities now than ever before, with a vast array of banking products, job opportunities, investments, payment options and insurance schemes. This abundance of options can be overwhelming, making it difficult for both young people and adults to know where to start on their financial journey.

The good news

It's not all doom and gloom—just a reality check. We can improve outcomes for the next generation by giving them the financial knowledge they need for a head start on their financial journey. Learning to manage money from an early age can mean the difference between financial security and a lifetime of struggling to make ends meet.

How do you teach financial literacy to your kids if it's not your strong point? MoneyTime’s online program teaches children aged 10 to 14 essential life skills for managing and growing their money. It’s a comprehensive, self-paced program that's easy for kids to navigate. They earn virtual money for correct answers and then decide how to spend it—whether to shop at virtual stores, donate, or invest in further education and property to increase their long-term wealth. This way, children learn the consequences of their financial decisions without risk or fear of failure.